Personal Finance is a very important part of our life. Understanding and Managing it makes a way for a happy and peaceful life. Let’s dive in. A year ago, I was reading Million Dollar Weekend, which broke down a simple but powerful personal finance idea —

the Freedom Number — the amount you need each month to run your life with peace of mind.

It reminded me of something Prof. Dr. Saras once said during her Effectuation seminar at IIM Bangalore (2013):

“What is something affordable to lose?”

Both ideas point to the same freedom — freedom from mental pressure.

As founders, when we know our minimum numbers and affordable losses, we stop fearing the unknown and start building with clarity.

In my book I’m NOT Busy (https://go.habitzup.com), I left readers with this reflection:

If you had 24 hours with no meetings, no pressure, what would you do?

When you combine these three reflections:

1. Your Freedom Number (monthly peace budget)

2. Your Affordable to Lose (risk comfort zone)

3. Your Free 24 Hours (purpose window)

You begin to discover the sweet spot of your purpose – without anxiety or comparison.

For me, the numbers were simple:

– Freedom Number: ₹1L per month

– Affordable to Lose: ₹10L

– Free Time: All the time I needed to build ActOnMagic – and later, sell it to NTT Netmagic.

Now, I’m walking the same path again with HabitZup, this time with a noble cause — helping people reflect, reset, and rediscover meaning in daily life.

So I’ll leave you with these three questions:

- What is your Freedom Number?

- What’s affordable for you to lose?

- And what do you truly want to build when you have all the time in the world?

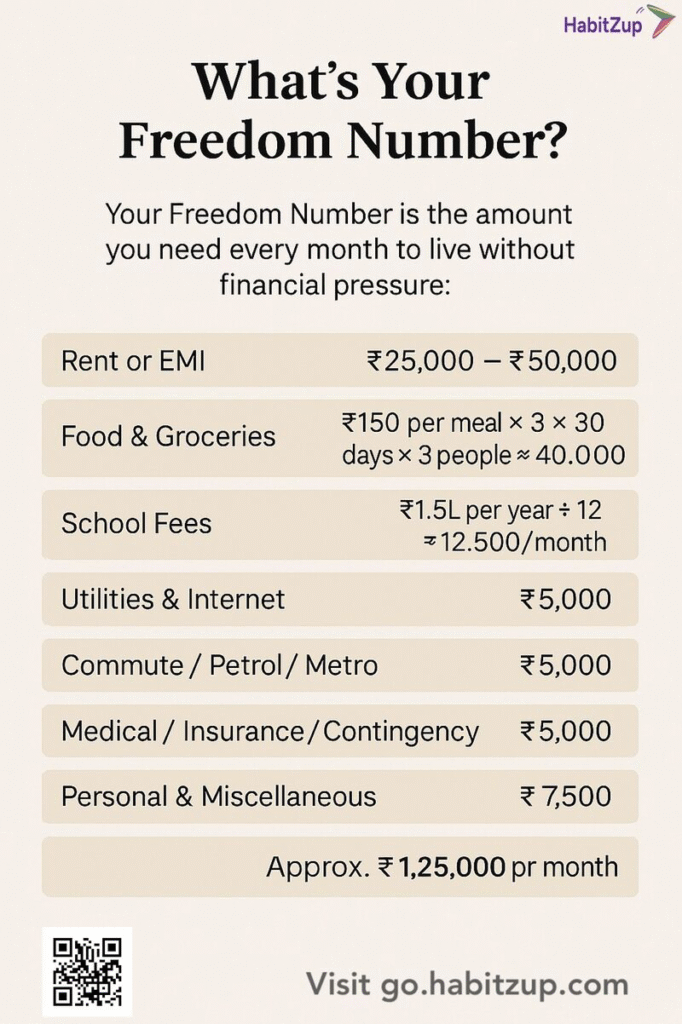

Personal Finance: Freedom Number

What’s Your Freedom Number? | Most of us chase “more” – more income, more growth, more things.

But very few pause to ask, how much is enough to live peacefully and purposefully?

Your Freedom Number is the amount you need every month to live without financial pressure – to make choices from clarity, not compulsion.

Here’s a simple way to calculate it:

- Rent or EMI: ₹25,000 – ₹50,000

- Food & Groceries: ₹150 per meal × 3 × 30 days × 3 people ≈ ₹40,000

- School Fees: ₹1.5L per year ÷ 12 ≈ ₹12,500/month

- Utilities & Internet: ₹5,000

- Commute / Petrol / Metro: ₹5,000

- Medical / Insurance / Contingency: ₹5,000

- Personal & Miscellaneous: ₹7,500

- That’s roughly ₹1,25,000 per month – your Freedom Number.

It’s not about luxury. It’s about knowing your peace threshold — the number that gives you mental space to think, create, and choose your purpose wisely.

Once you know it, you stop asking, “How can I earn more?”

And start asking, “What do I want to build now that my basics are covered?”

Have you discovered your Freedom Number yet?